See what you did there? For a brief moment after taking in that grouping of words from the title of this post you imagined a different life for yourself, a life free from debt. Save your imagination for the good stuff – vacations with loved ones, quitting that job you despise, doing more of whatever it is you most enjoy. You’ve identified the problem that is your debt. If you’re willing to hold yourself accountable and do the hard work required, the No Debt Bet Challenge is for you.

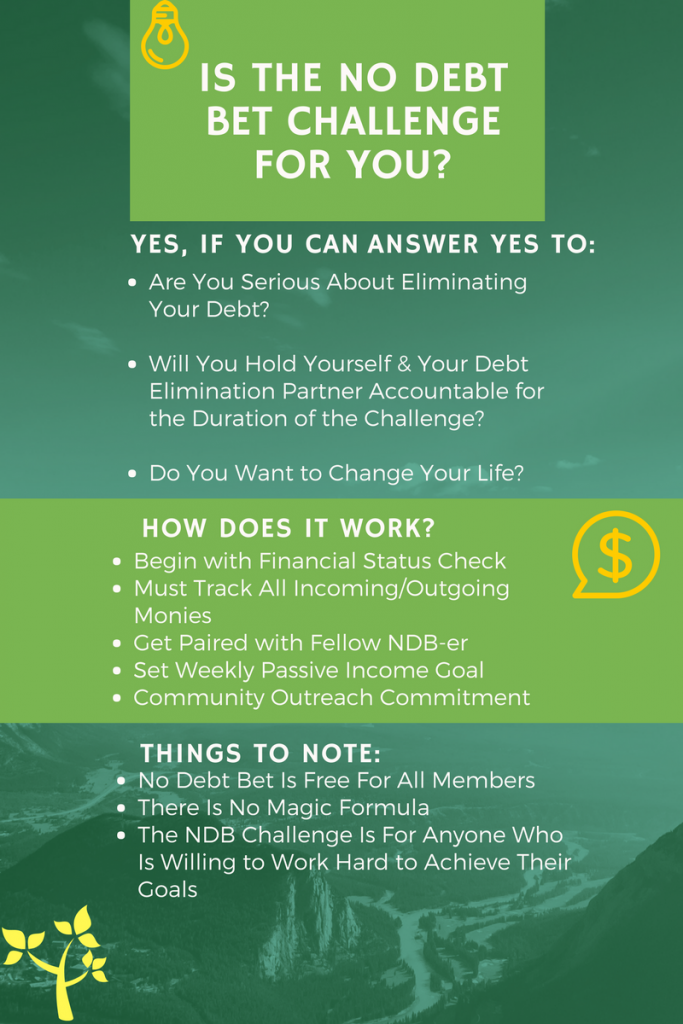

The No Debt Bet Challenge: Is It For You?

Accepting the No Debt Bet Challenge is a pledge to your No Debt Bet team members, especially your ‘Debt Elimination Partner(s),’ that you will not quit on them or yourself until you have realized the goals you set. Without commitment and accountability, No Debt Bet ceases to exist. Do the work and you will reap the rewards for the rest of your days.

Your Debt Elimination ‘Why’

‘He who has a why to live can bear almost any how.’ –Friedrich Nietzsche

It’s easy to focus on the anxiety and feelings of shame that often come to mind when you think about your debt. Perhaps the tab is so large you opt to pretend it doesn’t exist at all. Difficult to form a plan of attack in either case. Your No Debt Bet Team will help you rise above negative thought patterns and in the process you’ll become part of something greater than yourself.

Start with your ‘why.’ Looking beyond the obvious constrictive nature of debt, what is it specifically that has brought you to this website at this moment? Is your debt putting a strain on your marriage or romantic relationship? Tethering you to a job you despise? Maybe you’d just like to build up a decent emergency savings fund or put away more money for your child’s college education? What your debt reduction ‘why’ is doesn’t matter. What does matter is that you know it, write it down, and you place it in a highly visible location – for your daily viewing dissatisfaction. Get mad! Do something to reduce your debt everyday and know that a new ‘best version of you’ is born each morning you wake up and take action.

You Can’t Get Where You’re Going If You Don’t Know Where You’re Headed

If you are happy in your current career and eliminating your debt is your ticket to the good life, keep your ‘why’ in your heads up display and proceed with your Debt Funeral planning.

For the rest of the schmoes (blog creator included), eliminating your debt isn’t going to solve all of your worldly problems. In fact, without a clear understanding of what it is you’re trying to accomplish in life, you’re likely to end up right back where you started – in debt and unhappy (again, see blog creator).

This is going to sound odd, and a good number of you will probably write this nonsense off right here, but take a few minutes to write down three versions of your future self. Huh? That’s right – from a career standpoint – write down three people you could potentially evolve into. You don’t have to eliminate your ‘current self.’ Perhaps with some tweaking and/or promotion(s) you’d be happy to stay in your current career field. Just create at least three personas of you.

Note: No one is saying you can’t become an astronaut, pro golfer, or the president of the United States. However, for most, the more realistic your ‘alternate versions of you’ are the better.

Okay. What’s the point here? If you’re like many people out there in the world you ask yourself questions like these:

‘Why can’t I just do something I’m passionate about?’

‘Will I ever find a job I’m satisfied with?’

‘What is it that I’m looking for in life?

‘Is this really what’s going to make me happy?’

The problem is not you. You’re just asking yourself the wrong questions. Look at your ‘three versions of you.’ Choose one, the one that is most appealing to you at this moment. Now take a minute to imagine how you’d feel as that version of yourself. Feels good, right? The truth is we’re all many different ‘versions of ourselves’ over the course of our lives. Acknowledge it and remind yourself, whenever you start asking ‘those questions,’ that you have the power to become the new best version of you at any time. All you have to do is identify where you want to be, plot your course to get there, and TAKE ACTION to ensure you arrive at your desired destination.

Listen to this clip about Design Thinking from NPR’s ‘The Hidden Brain’ for more information about the research behind this exercise.

NDB Debt Elimination Methodology Part I

After you commit to the No Debt Bet Challenge and you’re paired with your Debt Elimination Partner, you immediately start hacking away at that giant tree of debt. Right? Wrong. False. Negative.

Have a Firm Grasp of Your Current Financial State.

- Create A List of All Outstanding Debts

- Order Debts from Highest to Lowest Interest Rate

- Include Current Balance for Each Debt

- Calculate Your Net Monthly Income (i.e., After Tax Income)

- If Your Monthly Income Is Inconsistent, Use a Conservative Estimate You Are Unlikely to Drop Below

- Mentally Commit to Tracking Every Dollar You Touch (Literally & Figuratively)

- Cashtrails, Mvelopes, Everydollar, & Mint Are Just a Few of the Budgeting Applications Currently Available

Plan Your Debt Funeral

Have that ‘why’ of yours written down? Give it a quick read because things are going to get painful before they get better.

Is Your Debt Funeral Scheduled?

Your next goal is to establish an emergency fund. The suggested amount is equal to, or greater than, your target monthly debt reduction amount (a challenging, yet achievable monthly debt pay down amount you established; Schedule Your Debt Funeral). If your goal is to pay $500 per month toward your debt, build your emergency savings to $600. You’re allotted 40 days (from the day you commit to the No Debt Bet Challenge) to establish your emergency fund – make each one count. In the event you already have a sufficient rainy day fund established, you may opt to double it or proceed directly to the debt smashing. Once you establish your emergency fund you’ll be part of a striking minority group of Americans able to endure an unexpected $500 expense*.

In an effort to ensure your savings account continues to thrive while you progress through the NDB Challenge, an automated savings program is encouraged. Set up an allotment that comes directly out of your paycheck (if your employer does not allow this, you can setup an auto draft that occurs on payday) and goes directly into a ‘high yield’ savings account. Barclays Online Savings is a one option. Barclays interest rates were 1.5% when this post was published. After a pay period or two you’ll forget all about the allotment, and you’ll have a sizeable emergency fund before you know it!

There are also several great applications that allow you to automatically invest your ‘spare change’ in an Exchange-Traded Fund (ETF). ETF’s track index funds (e.g., Nasdaq, NYSE, etc) and provide the lay investor with an opportunity to establish a money market account whilst eliminating barriers to entry (finding a stock broker, opening required accounts, etc). There are several ETF applications to choose from – Betterment, Wealthfront & Acorns are widely used. Many No Debt Bet-ers have found Acorns works well for initial investors. The fee schedules do vary, so make sure you read the fine print. Ohh… and a note regarding how most of these apps work: you simply link your bank account and set a ‘round-up’ and/or monthly investment amount. The app then rounds your purchases up (e.g., you pay $9.99 for a six pack, app rounds up to $15 and invests the difference for you) to ensure you meet your monthly savings goal. You’ll barely notice the money has moved to a separate account, and you can withdraw your money whenever you like. What do you have to lose?

No Debt Bet Elimination Methodology Part II

A quick status check before you unleash your debt demolishing plan of attack:

1)You have your ‘why’ and your debt funeral date established.

2) You have both written down and posted in a spot where you will read them EVERY DAY (e.g., bathroom mirror, computer monitor, car dashboard).

3) You and your Debt Elimination Partner have both subscribed to the <ahref: newsletter> and joined the <ahref: NDB FB Group>. If you are joining individually, you have indicated such (via Newsletter sign-up form) and have, or will soon, meet your Debt Elimination Partner.

4) You know your Monthly Debt Reduction Goal

You know what your goal is and you know when you are going to accomplish it. The only way out is through. As Jocko Willink likes to say: GET AFTER IT.

Enter No Debt Bet Challenge mode. With your Monthly Debt Reduction Goal in hand and your Debt Elimination Partner chipping away at her debt right alongside you – where do you start?

There is no shortage of ‘debt payoff best practices’ floating around out there on the interwebs. The No Debt Bet Method is not a novel one, rather it is a combination of existing practices. The ‘snowball method’ popularized by Dave Ramsey suggests it’s best to start by paying off your smallest debt, regardless of interest rate, then the next smallest, and the next, etc., thereby creating a psychological snowball of emotion that propels you to eliminate your debt entirely. This method is not mathematically sound, but as Dave likes to say ‘if we were mathematicians, we wouldn’t be mixed up in this conundrum to begin with.’ The mathematically sound debt elimination method is essentially the opposite: begin by paying off your debt with the highest interest rate, regardless of the size of said debt, then pay off your next highest interest rate debt, and the next, etc. This method is ‘mathematically sound’ because you end up paying less in interest over the life of your loans.

The No Debt Bet Debt Elimination Prescription is a hybrid of the two methods:

A couple of points to note before you hit the submit button on your first round of debt payments:

- Negotiate, Negotiate, Negotiate!

- Call your creditors to see if they will reduce your interest rates. The worst they can say is no. If they agree – you just saved yourself a bunch of time and coin!

*Student Loan Hero is a great resource for anyone seeking to refinance their student loan debt and/or learn how to repair a damaged credit score.

- Debt consolidation/settlement is generally something to avoid. Both sectors are rife with con artists who do not have the consumer’s (your) best interests in mind (punny). Often you’ll be offered a lower monthly payment in exchange for longer payment terms and/or higher interest rates (which may mean you pay more over a longer period of time). This is not to say there are not reputable debt settlement/consolidation companies out there. Just do your due diligence, my fellow No Debt Bet-ers! If you do not understand something, do not enter into any contractual agreement. Seek professional advice.

The No Debt Bet Community Connection

From the outside looking in, one might view the No Debt Bet Community Connection as a ‘punishment’ of sorts. That thing you use to motivate yourself to meet your weekly debt reduction goal. While it is true that No Debt Bet-ers agree to complete four hours of community service for each week they fail to meet their weekly goal, they also agree to become a part of something profound. Something greater than themselves. By helping others you help yourself. Cliche? Sure. True? You decide.

‘You can get everything you want in life if you will just help enough other people get what they want.’

-Zig Ziglar

The No Debt Bet Team lives the Ziglar mantra. This is what our very first active team member, Jill, had to say after her first round of community service:

I volunteered with Habitat for Humanity today and loved it. I’ve always thought it’d be a fun, empowering way to offer my time, but never took the initiative UNTIL it was suggested by Tom and No Debt Bet. Thanks Tom. I’m in debt for many reasons, but one big one is a lack mindset I’ve acquired and hung onto and by giving back today to a cause that truly needed and appreciated my time had me feeling full of abundance. How exciting! Also, wanted to share that I went grocery shopping with my “Why” completely in the forefront of my mind, and found I ONLY bought what I needed and left the mindless snacks I like to buy out of my cart. I’m home now and would happily snack away on whatever I bought cause it’s here, but am so happy both my bank account and my health get to benefit from my more mindful shopping trip.

When you join the No Debt Bet Team you will be paired with another No Debt Bet-er. Once you meet your partner and establish your big three (your ‘why,’ your target monthly Debt Elimination Goal & your Debt Funeral Date), you’ll choose one to three community service organizations you would like to work with during the challenge. This is to ensure you are able to complete the sixteen maximum monthly hours, if necessary. The hope is that you will not be ‘required’ to complete any community service, but choose to do so anyway! All No Debt Bet team members agree to complete a minimum of four hours community service whether they meet all weekly Debt Elimination Goals or not. Join the No Debt Bet Team now to start smashing that debt and become a better you.

Here are just a few of the organizations the No Debt Bet Team works with: Team RWB, The Mission Continues, Habitat for Humanity, The Humane Society.

Non-w2 (Passive) Income Cultivation

What is ‘non-w2 income,’ you say? No surprises here: it’s income you generate outside of your typical income stream (note: you need not be a w2 wage earner to participate). Systematic debt elimination is just half of the No Debt Bet strategy, as part of the crew you will also establish a weekly (achievable) passive income goal. Sounds great. But, what’s a good starting point?

Step 1: Sell Your Shit

If you haven’t used it in 90 days or more, do you really need it? Man vs Debt is a good resource to help you determine which items sell best on a given platform (e.g., OfferUp, Ebay, Craigslist, etc). The kind folks at Man vs Debt also provide some tips regarding optimal item descriptions and photo techniques. If you find that you enjoy selling items and your supply runs low, you might look into an Amazon Seller account. You’ll want to do your due diligence prior to buying or selling items on this platform to avoid stockpiling product that is difficult to move.

Step 2: Identify Potential Sustainable Passive Income Streams

Write down 3 responses for each of the following:

-Your Greatest Strengths (think about skill set(s) you have – welding, writing, coaching, medical/legal expertise, cooking/food service, etc.)

-Problems You Have Encountered More than Once in the Last 90 Days

-Fears (Your Own or People Close to You)

-Interests/Hobbies

-Largest Consistent Expenses (Not Housing, Vehicle, or Food Related)

With your strengths in mind, choose your 3 most appealing responses. What product or service could you create to address a problem related to these issues? (hint: Don’t mull over it too intensely, just get in the habit of identifying problems in daily life and thinking about them in a constructive manner. The ideas will follow.)

And, voila! An idea is born. Now what?

‘Ideas are cheap. Execution is dear.’ -Rob Barton

Step 3: Identify Your Target Audience

Before you get all crazy and spend your life savings on your new and improved prototype bread slicing machine – think about what your typical customer looks like. What does she do for fun? Where does he live? What groups does she belong to? You have to know who your customers are before you can solve their problems. There is a great (free) target audience profile creator provided by CoSchedule. Keep it in your passive income toolbox, it will save you a lot of pain and dollar bills.

Step 4: Validate Your Product or Service

Product validation is the most crucial, most frequently neglected step in the business birthing process. Everyone has a million dollar idea. A small fraction of ‘everyone’ will take the steps required to bring their product or service to market. Many who do summit the all elusive market will quit after they’ve spent an embarrassing amount of time and/or money on something that was only ever useful to the target audience you glance at in the mirror each morning.

How can you avoid the fate of the innumerable enthusiastic would-be entrepreneurs you’ve never heard of who opted to skip the product validation step?

Talk to Your Target Audience (Online is Okay, In-Person is Better)

–Learn how to ask better questions. The NPS Survey is a great resource to help you ask very specific questions.

-Start with a hypothesis and try to disprove it (e.g., dog owners who live in urban areas will buy my reflective dog collars to ensure their pet’s safety. Where might you go to find dog owners?).

–Start a Meetup (or attend an applicable existing one) to gauge interest in your product or service

-Create a simple website describing your product and get your target audience to commit to buying from you before you produce anything. (No coding required with Shopify or Squarespace). Drive traffic to your site with an existing blog and/or social media accounts.

Don’t Get Caught Up In The Semantics

There will come a time when establishing an LLC, mass producing your product(s), and/or paying someone to build an app will be necessary. When you start out you should spend almost zero time on activities that are not directly related to identifying your target audience and validating your product or service. This post from the Tim Ferriss Blog provides a ton of great, very specific, free/low-cost ‘where do I start’ strategy.

Know How To Contact Your Potential Customers

Always, Always, Always collect contact information from your target audience online (via email subscribe list and Google Analytics data) and in-person (business card, write it down, LinkedIn).

Step 5: The ‘I Need Money Now’ Conundrum

Que J.G Wentworth advertisement – call (877) CashNow! If that isn’t an option, Fiverr is a great place to land contract gigs. Merchants will pay you to do copywriting, search engine optimization (SEO), manage website analytics, graphic design and more for them. Keep in mind it may be necessary to take on a few pro-bono and/or low paying bids to establish your rating when you’re starting out. Coming online with an existing portfolio is also helpful. If you’re interested in learning more about digital marketing certifications visit the Google Academy for Ads.

Inbox Dollars and Survey Junkie will pay you to complete online tasks, often in the form of answering survey questions after watching a commercial or playing a video game. It might not pay your mortgage, but it will line your pockets with a few extra greenbacks that would not have been there otherwise. For the more ‘in real life work’ types, contract work on sites like TaskRabbit and Thumbtack are good options. People will pay you to assemble IKEA couches, paint houses, help them move, landscape their yard, etc, etc.

But, What if I Just Don’t Have Any Good Ideas?

‘The riches are in the niches.’ – Pat Flynn

Well, that’s nonsense and you know it. You have a unique skill set that no one else has – it may be true that you have not taken the time to think about how you can use your knowledge to help others solve their problems. Luckily, you’re addressing that now. The Smart Passive Income Blog is an incredible resource for people in all stages of the passive income generation process. There is also an SPI podcast, start with episodes 192-194 for an overview of all things Smart Passive Income. The Side Hustle Podcast provides some great information as well.

As you begin to think about generating passive income of your own, keep your strengths and your skill set + life experiences in mind. When ideas start to percolate always ask yourself what problem you are solving for a given demographic. Don’t worry about monetization initially. If you can help enough people solve a problem, the money will come.

Related Citations:

*Forbes Article: Majority of Americans Unable to Endure Unexpected $500 Expense.